The subject of financial security is one that comes up quite frequently in my world. When you have a family to worry about, the bills can often seem overwhelming and insurmountable.

How to get out of debt, how to improve your credit, and how to accomplish your financial goals are tough subjects that weigh on a lot of families. When I bought my house I was terrified of the huge leap in my monthly bills. Then, when I began remodeling, I realized I was going to blow right through the budget I had. Over the course of a couple years I managed to rack up more credit card debt than I’d ever had before.

While I’ve never been a big spender, the combination of big bills and contractors to pay left me concerned about the state of my finances. Luckily for me I know Taralyn Rose, a Certified Financial Counselor with California Coast Credit Union. I asked her a million questions about how to get myself back on track, and she was a wealth of knowledge. Recently I picked her brain again so that I could share that knowledge with those who may feel the same way I did a few years ago.

ME: What does a first meeting with someone interested in working on their finances look like?

TR: The first meeting includes a lot of homework. I ask that my clients come in prepared to share their income, credit, debts, assets, and any other relevant financial information. Often overlooked are the periodic expenses, including annual memberships, DMV renewals, and holiday spending. We spend time going over how to use tracking sheets in order to get a better understanding of where the money goes each month. We look at credit reports, balance sheets, income statements and work on identifying goals. One of the main things I want people to be able to assess is what their financial goals are. Once I know what they are aiming for I can tailor the approach to meet those needs.

ME: What are the most frequent goals you hear?

TR: Mostly I find that people want a combination of four main things: Buy a house, pay off debts, save more, and stop living paycheck to paycheck. Some people want all of these things and some only want one or two, but these four are the most common goals I hear.

ME: And what do you tell people about how you will help them reach those goals?

TR: The first meeting can be a tough one. As well as homework that includes tracking how they spend each month, they need to figure out why they are in a position where they feel they cannot make ends meet. Living paycheck to paycheck is very stressful for most people, but there are many ways to solve the problem. I like to find out what is driving their spending habits.

Oftentimes, overspending is an emotional issue. The mentality that “I deserve this, I work hard” is common and can be hard to recognize and overcome. It becomes a problem when what you tell yourself you deserve puts you in a position that you can no longer achieve your financial goals. Recognizing the ‘why’ is an important first step in the process of figuring out goals and what is standing in the way of attaining them.

I also let my clients know that I will never tell them what they have to spend their money on. It is their money and they can spend it how they see fit, but if they want to reach certain goals they may have to weigh what they want right now versus what they are working toward for their future. I want to know their goals so I can give them suggestions on how to get there, and also help them recognize when money is being spent on things that do not help them in the long run.

I can help with setting goals, assessing spending habits, fixing credit problems, and establishing accounts to reach those goals. I will go over each of these items individually and at the pace that works for that person. Some financial situations are much more complicated than others and can take a while to straighten out. Plus, each person’s situation is different, so finding the approach that works best is a very personal thing.

ME: What do you seek to accomplish in the first meeting?

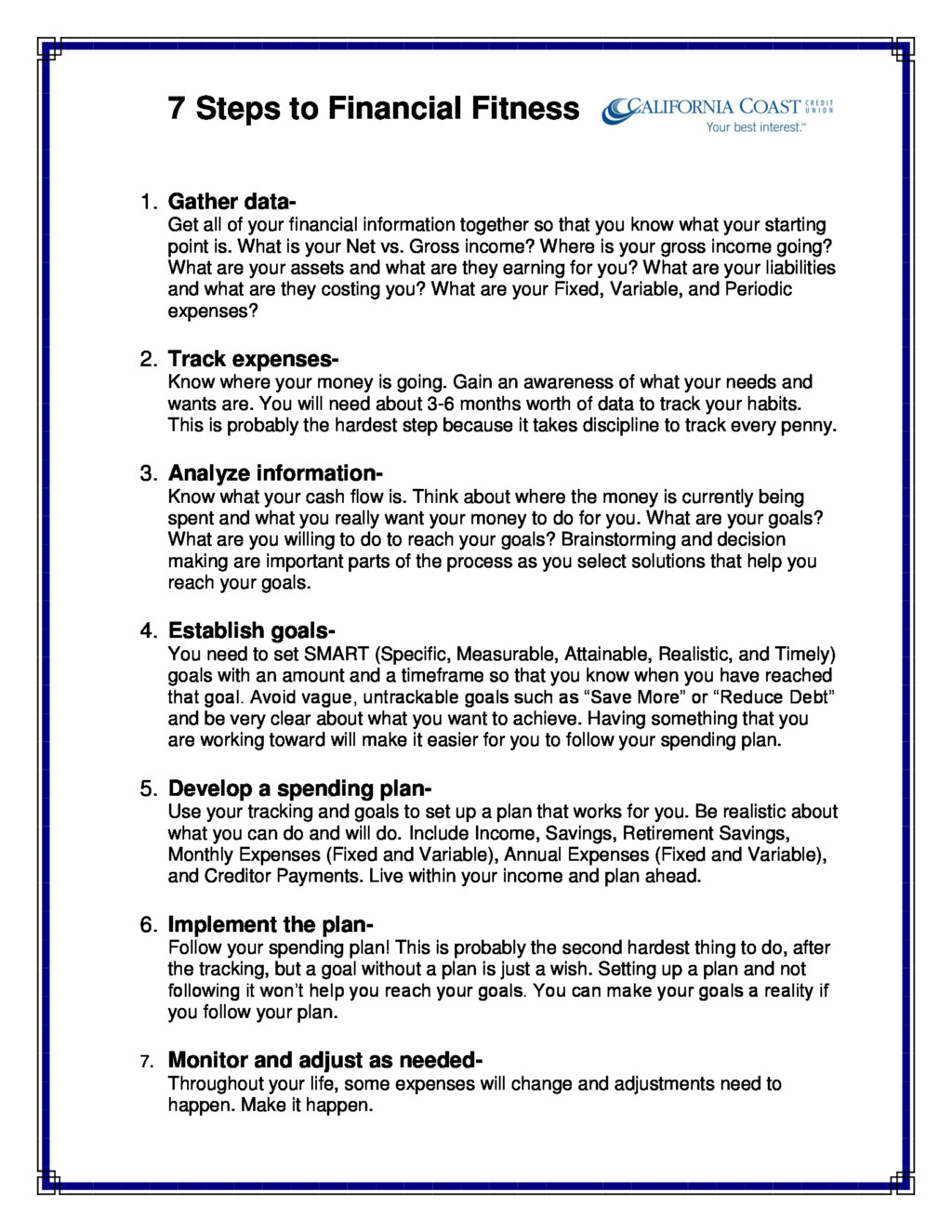

TR: The main themes of the first meeting are awareness and hope. My goal is to have each person leave with a sense that they have an understanding of exactly where they currently stand financially, and know that they are capable of accomplishing their goals with a little work. In addition to the tracking homework, I developed the 7 Steps to Financial Fitness worksheet that I give to each person during the first meeting. It outlines the process we will go through over the next few months (or longer) and provides them with structure and expectations for a task that can sometimes seem daunting. Then, I will set up a follow-up for about a month away. This gives them time to go through a typical month’s spending and track everything coming in and going out. When they come back, we go through every expenditure, total up the categories, and start determining how to get from the current situation to the goals they have in mind.

AWH!!!! I love Taralyn Rose! Meet with her many many years ago to start the nasty “finance” talk. She’s fabulous and her tips are spot on! Thanks for sharing this. Always needing a refresher. 😉

This is really helpful. I’d like to hear more about financial fitness. Thank you for sharing!